The ToFish micro finance app will be coming soon…

Illustrations by storyboard artist Dean Mortensen: find Dean on IMDb

Micro Finance Will Never Be The Same Again

Date: November 4, 2021:

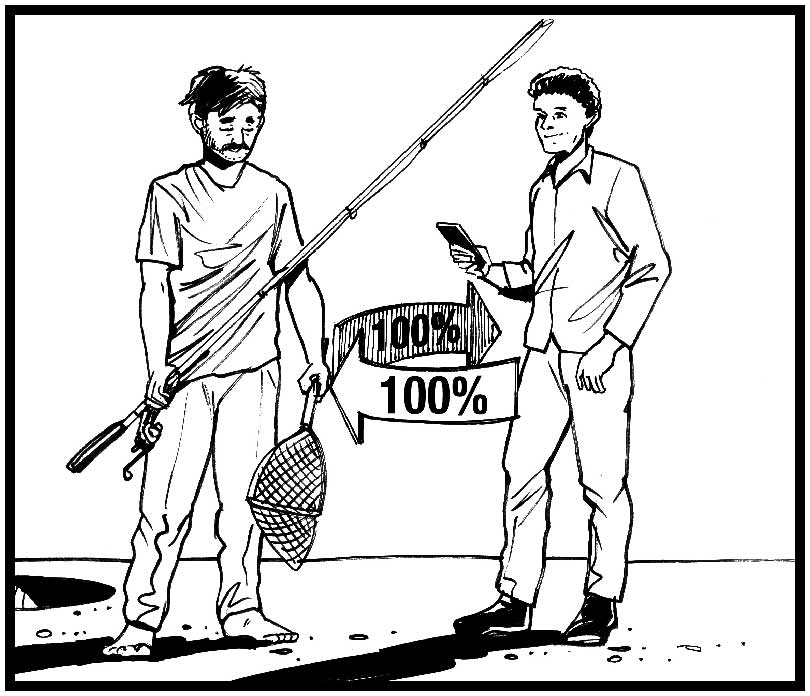

The ToFish micro finance mobile app will be “the” way anybody can provide a micro finance loan to an individual in the developing world. The ToFish app will enable the recipient of the loan to receive the full amount of the loan, eliminating the middleman.

Micro finance: small loans of typically around $150 that are lent to people in countries where no other form of finance is available. It is directed towards those who have a desire to help themselves by starting a business of their own, in order to break the poverty cycle that they are currently stuck in.

Micro finance is provided as “no-interest” or zero % interest loans and can be paid back at a pace that suits the borrower. Micro finance helps to facilitate the old adage, “Give a man a fish, feed him for a day. Teach a man to fish, feed him for life”.

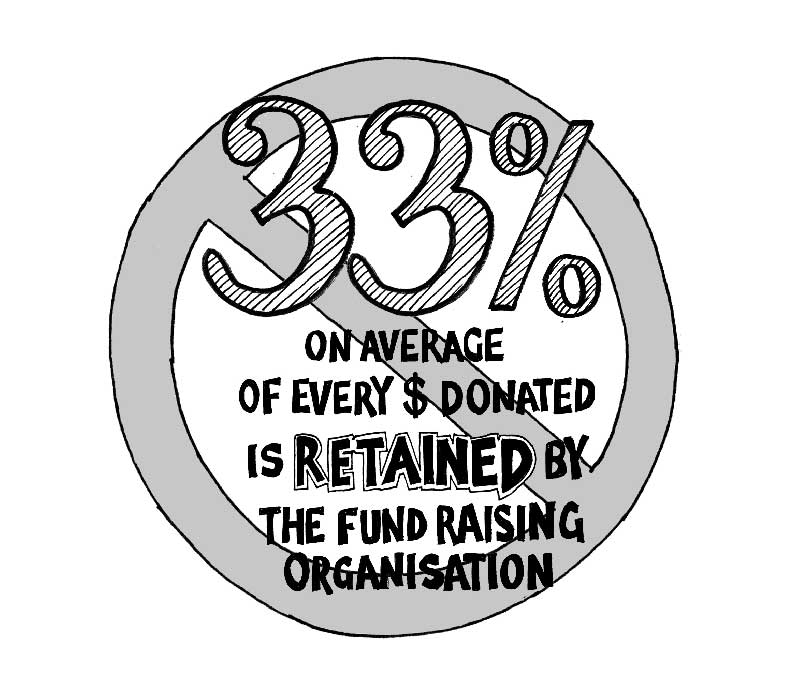

Unique: My decentralized mobile app (dapp) is designed to utilize the blockchain to enable funds to be directly sent to the person’s need, thus avoiding any middleman costs. By eliminating the potential loss of up to a third of every dollar donated to the fund raising organization’s overheads, you are ensuring every cent is going the person in need.

The ToFish app will be engineered to connect verified clients who have a genuine need, directly to validated suppliers of goods, livestock or machinery – tasks that the charity organizations will carry out independent of the ToFish app, at their own expense. This means that the fund raiser receives no part of the loan provided by the lender.

The average percentage that fund raisers consume from your donated dollar is *33%, which is a major stumbling block in the minds of potential charitable giving. On the other hand, the ToFish app will eliminate any of this cash burn from the donation dollar, ensuring 100% will benefit the borrower.

ToFish will provide the direct way for people who want to know where their charity money is going and to whom it will be sent, with the full reassurance that not a single cent will be taxed out by fund raising organizations.

100% of a typical $150 loan will go directly to the certified supply of the goods, enabling the release or delivery of the goods being supplied to the lender or individual in need.

So How Does A Loan Recipient Repay Their Loan?

Suggested Repayment Approach:

Loan Disbursement in BTC:

- Disburse the loan amount (e.g., $150 USD) in BTC to the recipient’s wallet via the Lightning Network. Ensure recipients have a user-friendly wallet compatible with Lightning transactions.

Repayment in Local Currency:

- Allow recipients to repay their loans in local currency. They can make repayments in their local currency through various payment methods like mobile money, bank transfers, or cash deposits at designated locations.

Currency Conversion Mechanism:

- Integrate a currency conversion mechanism into the app. When the recipient makes a payment in local currency, the app will:

- Convert the local currency amount into USD based on the current exchange rate.

- Calculate the equivalent BTC amount using the current BTC/USD exchange rate.

- Integrate a currency conversion mechanism into the app. When the recipient makes a payment in local currency, the app will:

Periodic Reconciliation:

- The app can periodically (e.g., daily or weekly) reconcile the collected local currency payments, convert them into BTC, and transfer the equivalent BTC amount to the organization’s BTC wallet.

Transaction Records:

- Maintain detailed records of all transactions, including the amounts paid in local currency, the conversion rates used, and the BTC amount credited to the organization’s wallet. This ensures transparency and accountability.

Example Workflow:

Loan Disbursement:

- The organization disburses $150 USD worth of BTC to the recipient’s wallet using the Bitcoin Lightning Network.

Recipient Repayment:

- The recipient makes a repayment of 10,000 local currency units.

- The app converts 10,000 local currency units to USD (e.g., if the exchange rate is 100 local currency units per USD, the repayment is $100 USD).

- The app then converts $100 USD to BTC at the current BTC/USD exchange rate and credits the equivalent BTC amount to the organization’s BTC wallet.

Continuous Monitoring:

- The app continuously monitors exchange rates to ensure accurate conversions.

- The organization can set up alerts or automated reports to track repayment progress and currency fluctuations.

Key Considerations:

Exchange Rate Volatility:

- Mitigate the impact of exchange rate volatility by using real-time exchange rates and possibly setting limits on acceptable fluctuations.

User Education:

- Educate recipients on how to use the app and understand the repayment process, especially the currency conversion aspect.

Regulatory Compliance:

- Ensure compliance with local financial regulations, especially concerning currency exchange and the use of cryptocurrencies.

Security:

- Implement robust security measures to protect user data and transactions, including encryption, two-factor authentication, and secure key management.

By following this approach, you can facilitate the repayment of microfinance loans in local currency while ensuring that the repayments are ultimately converted to BTC and credited to your organization’s BTC wallet.

Update on this project very soon..

*https://www.lohud.com/story/news/politics/politics-on-the-hudson/2017/11/28/how-much-your-donations-actually-go-charity/108104626/